The Kwacha: A Journey Via Zambia’s Foreign money

Associated Articles: The Kwacha: A Journey Via Zambia’s Foreign money

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to The Kwacha: A Journey Via Zambia’s Foreign money. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

The Kwacha: A Journey Via Zambia’s Foreign money

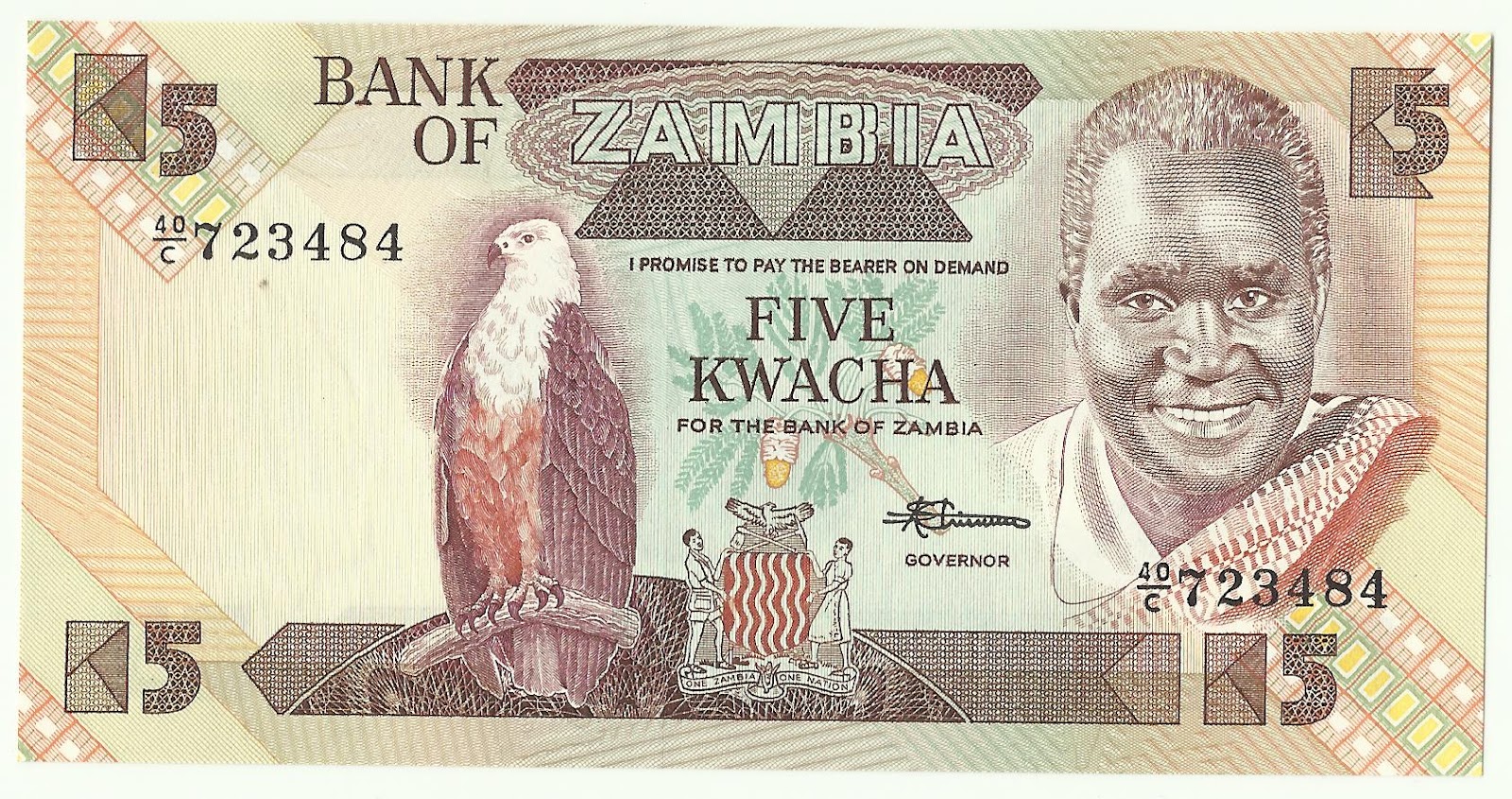

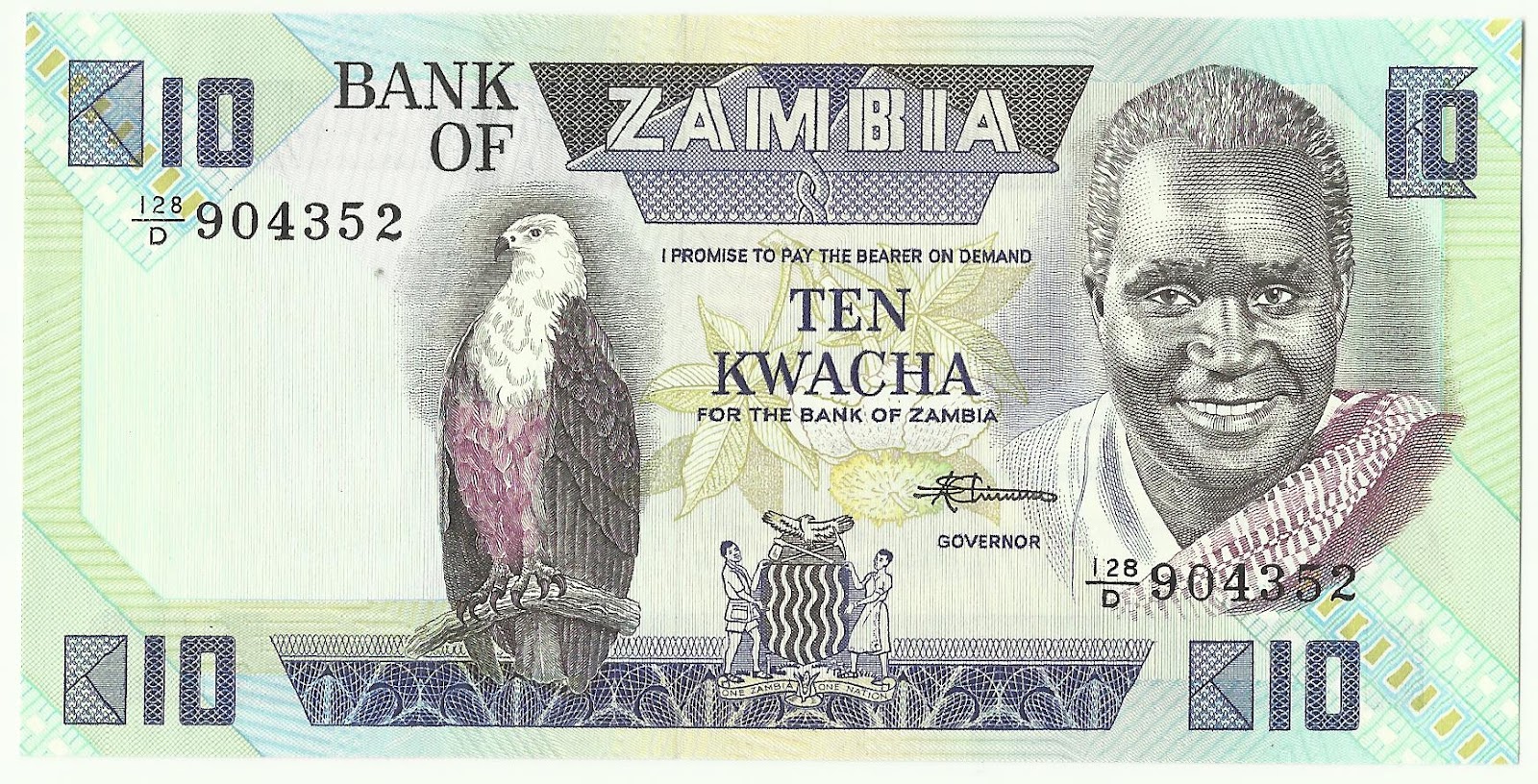

The kwacha, that means "daybreak" or "dawn" within the Chewa language, is the official foreign money of Zambia. Its journey displays the nation’s financial historical past, marked by durations of increase and bust, and its ongoing battle for stability and development. Understanding the kwacha’s evolution, its present challenges, and its future prospects requires delving into Zambia’s broader financial context, its relationship with international markets, and the federal government’s financial insurance policies.

Historic Context: From the Pound to the Kwacha

Earlier than independence in 1964, Zambia, then Northern Rhodesia, used the British pound as its foreign money. The transition to an unbiased foreign money was a major step in the direction of nationwide identification and financial sovereignty. The kwacha was launched on twenty fourth December 1965, changing the pound at a fee of 1 kwacha to at least one pound. This preliminary interval noticed a comparatively secure kwacha, anchored to the British pound inside a set trade fee system. This stability, nevertheless, was largely contingent on the energy of the British economic system and the worldwide financial local weather.

The early years of the kwacha noticed Zambia profit from the copper increase, its main export commodity. Copper costs remained excessive, fueling financial development and contributing to a comparatively robust and secure foreign money. Nonetheless, this era additionally witnessed the beginnings of vulnerabilities. The economic system grew to become closely reliant on copper, leaving it vulnerable to fluctuations in international commodity costs. Moreover, a scarcity of diversification within the economic system meant that the nation’s financial well being was intrinsically linked to the efficiency of the copper sector.

Challenges and Fluctuations: The Affect of International Markets

The late Seventies and the Nineteen Eighties introduced vital challenges. A world decline in copper costs, coupled with rising oil costs and the growing debt burden, severely impacted Zambia’s economic system. The kwacha started to depreciate towards main currencies, resulting in durations of excessive inflation and financial hardship. This era highlighted the inherent dangers of relying closely on a single commodity for export income. The structural adjustment applications carried out by the Worldwide Financial Fund (IMF) and the World Financial institution, whereas aiming to stabilize the economic system, typically resulted in painful austerity measures that negatively impacted the inhabitants.

The Nineties noticed the adoption of a market-oriented trade fee system, transferring away from the fastened trade fee regime. This shift aimed to extend the pliability of the kwacha and permit it to regulate to market forces. Whereas supposed to enhance effectivity, this transition additionally led to elevated volatility within the kwacha’s worth. The foreign money skilled vital fluctuations, reflecting the interaction of worldwide commodity costs, investor sentiment, and home financial insurance policies.

The early 2000s witnessed a interval of relative stability, partly as a result of improved copper costs and prudent macroeconomic administration. Nonetheless, the worldwide monetary disaster of 2008-2009 as soon as once more highlighted the vulnerability of the Zambian economic system and the kwacha to exterior shocks. The decline in copper costs and lowered international demand led to a renewed depreciation of the kwacha, triggering inflationary pressures.

Latest Developments and Present Challenges

Lately, Zambia has confronted a confluence of challenges impacting the kwacha’s stability. Excessive ranges of public debt, exacerbated by borrowing to finance infrastructure initiatives, have put immense stress on the foreign money. Moreover, the COVID-19 pandemic and the next international financial slowdown additional strained the economic system, resulting in a major depreciation of the kwacha. The reliance on copper, regardless of efforts at diversification, continues to be a serious vulnerability. Fluctuations in copper costs stay a major determinant of the kwacha’s worth.

The Zambian authorities has carried out varied measures to deal with these challenges, together with in search of help from the IMF by way of debt restructuring applications. These applications usually contain austerity measures and structural reforms aimed toward bettering fiscal self-discipline and selling sustainable financial development. The success of those measures in stabilizing the kwacha and fostering long-term financial development stays to be seen.

Financial Coverage and the Financial institution of Zambia

The Financial institution of Zambia (BOZ) is the central financial institution chargeable for managing financial coverage and sustaining the soundness of the kwacha. Its main instruments embody adjusting rates of interest, managing overseas trade reserves, and implementing varied regulatory measures. The BOZ’s effectiveness in managing the kwacha’s worth is influenced by quite a lot of elements, together with the worldwide financial surroundings, home financial situations, and the federal government’s fiscal insurance policies. A coordinated strategy between fiscal and financial insurance policies is essential for reaching macroeconomic stability.

The BOZ has confronted the problem of balancing the necessity for value stability with the necessity to help financial development. Sustaining a secure kwacha is essential for controlling inflation and defending the buying energy of residents. Nonetheless, overly tight financial insurance policies can stifle financial exercise, doubtlessly resulting in job losses and slower development. Discovering the suitable stability is a posh and ongoing job.

The Way forward for the Kwacha: In direction of Sustainability

The way forward for the kwacha relies on quite a lot of elements, together with the success of ongoing financial reforms, the diversification of the Zambian economic system, and the worldwide financial outlook. Lowering reliance on copper and fostering development in different sectors, corresponding to agriculture, tourism, and manufacturing, are important for constructing a extra resilient economic system. Bettering governance, tackling corruption, and selling investor confidence are additionally essential for attracting overseas funding and supporting financial development.

The implementation of sound fiscal and financial insurance policies by the federal government and the BOZ is paramount. This contains sustaining fiscal self-discipline, controlling public debt, and successfully managing overseas trade reserves. Moreover, strengthening establishments, bettering infrastructure, and investing in human capital are important for long-term sustainable growth.

The kwacha’s journey has been a mirrored image of Zambia’s financial journey. Whereas the foreign money has confronted vital challenges, its resilience and its continued existence symbolize the nation’s ongoing efforts in the direction of financial stability and prosperity. The trail forward requires sustained dedication to structural reforms, diversification, and accountable macroeconomic administration. Solely then can the kwacha really replicate the daybreak of a brighter and extra sustainable future for Zambia. The success of those efforts is not going to solely decide the soundness of the kwacha but additionally the general well-being of the Zambian individuals. The "daybreak" represented by the kwacha’s identify should be greater than only a symbolic illustration; it should turn into a tangible actuality for the nation.

Closure

Thus, we hope this text has offered worthwhile insights into The Kwacha: A Journey Via Zambia’s Foreign money. We admire your consideration to our article. See you in our subsequent article!