Decoding the Canadian 5-12 months Bond Charge: A 5-12 months Outlook and Market Watch

Associated Articles: Decoding the Canadian 5-12 months Bond Charge: A 5-12 months Outlook and Market Watch

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Decoding the Canadian 5-12 months Bond Charge: A 5-12 months Outlook and Market Watch. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Decoding the Canadian 5-12 months Bond Charge: A 5-12 months Outlook and Market Watch

Canada’s 5-year bond fee serves as an important benchmark for rates of interest throughout the nation, influencing every part from mortgage charges and shopper borrowing prices to company funding choices and the general well being of the economic system. Understanding its fluctuations and underlying drivers is important for buyers, companies, and policymakers alike. This text delves into the present state of the Canadian 5-year bond fee, analyzing its latest efficiency, the components influencing its trajectory, and providing a potential outlook for the subsequent 5 years.

Current Efficiency and Present Panorama:

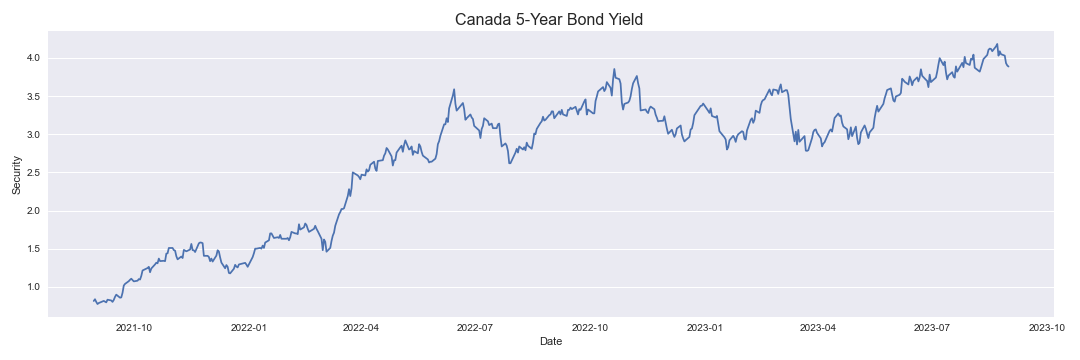

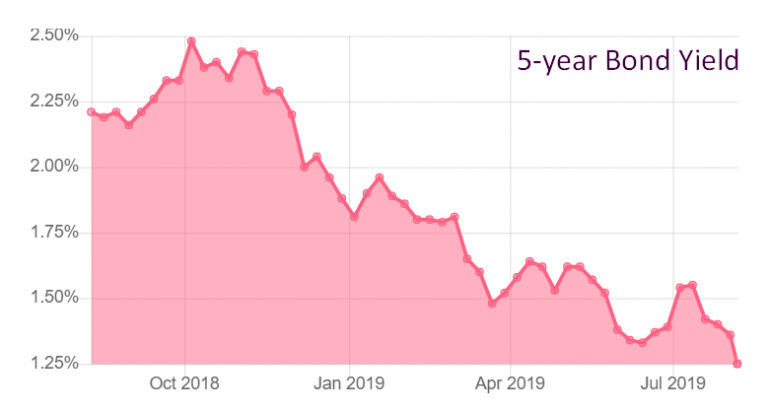

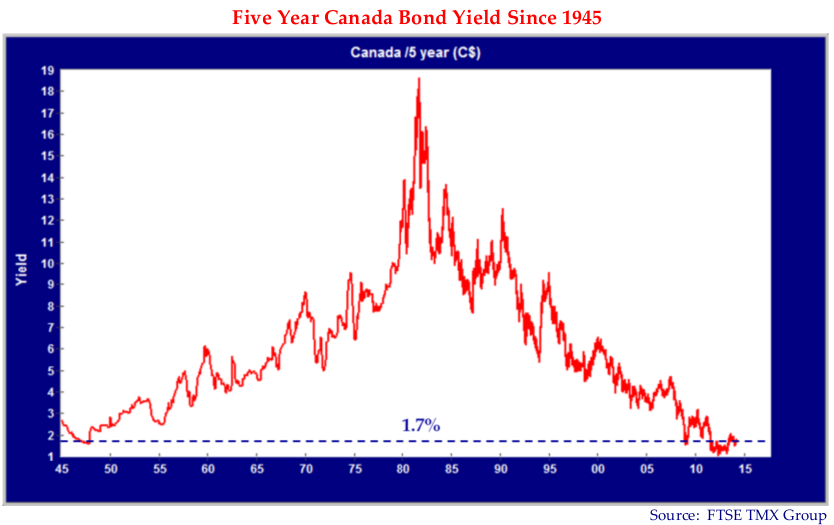

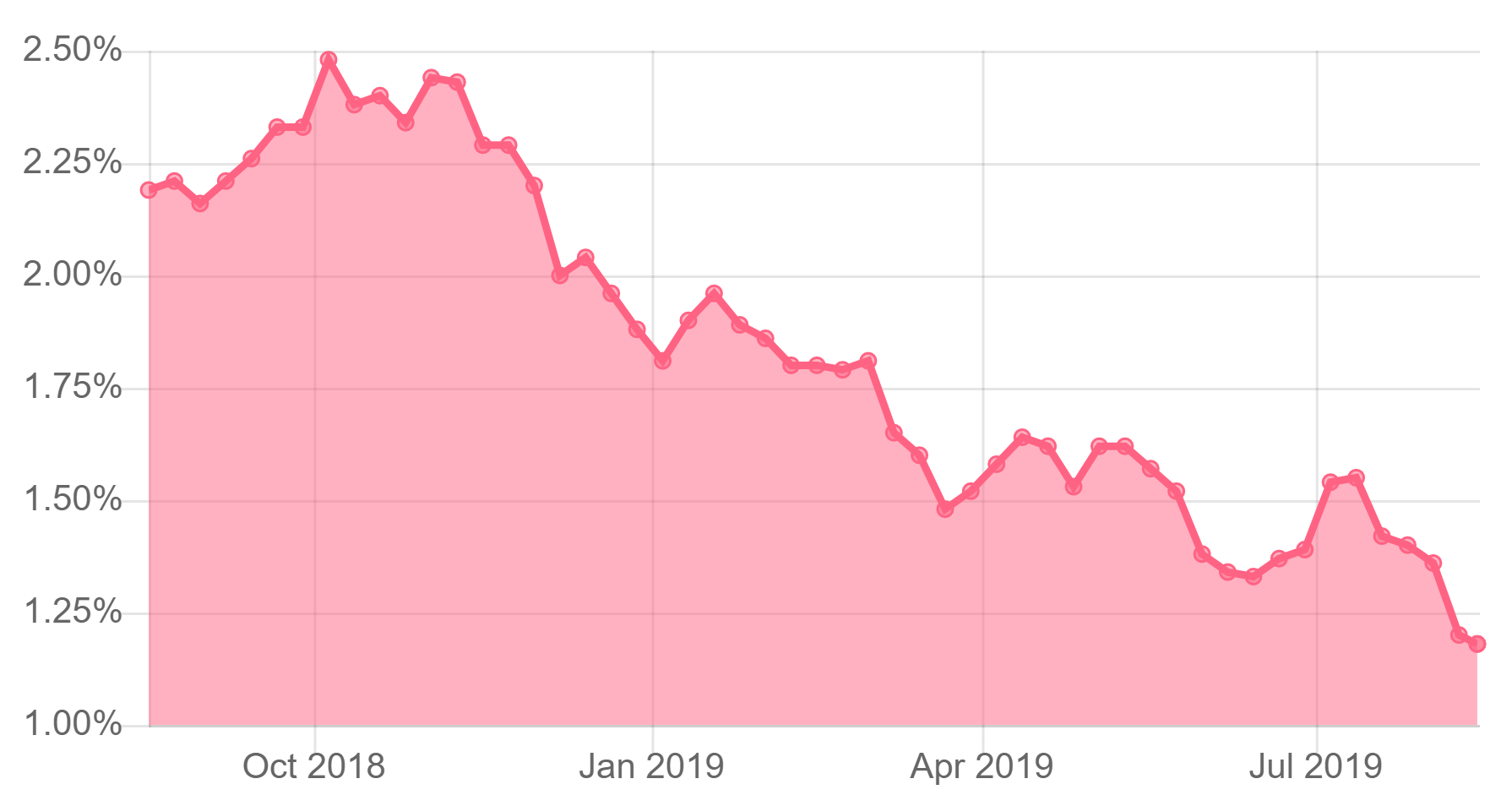

The Canadian 5-year bond fee, like its international counterparts, has skilled important volatility in recent times. The interval main as much as and together with the COVID-19 pandemic witnessed unprecedented financial easing by the Financial institution of Canada (BoC). Rates of interest had been slashed to near-zero ranges to stimulate the economic system and forestall a deeper recession. This resulted in a dramatic decline within the 5-year bond fee, reaching traditionally low ranges.

Nonetheless, the following financial restoration, fueled by authorities stimulus and pent-up demand, led to inflationary pressures. This pressured the BoC to embark on a fast sequence of rate of interest hikes, reversing its earlier easing coverage. Consequently, the 5-year bond fee has climbed considerably, reflecting the elevated value of borrowing. The precise degree fluctuates each day, reflecting the dynamic interaction of varied financial indicators and market sentiment. Monitoring this fee requires a detailed watch on a number of key components.

Key Elements Influencing the Canadian 5-12 months Bond Charge:

A number of intertwined components contribute to the fluctuations within the 5-year bond fee:

-

Financial institution of Canada Financial Coverage: The BoC’s coverage fee is essentially the most important driver. Adjustments to the in a single day fee instantly influence borrowing prices throughout the yield curve, together with the 5-year bond fee. Ahead steerage from the BoC, indicating future fee hike expectations, additionally considerably influences market expectations and bond yields. Analyzing the BoC’s statements, press conferences, and financial coverage studies is essential for understanding the course of rates of interest.

-

Inflation: Inflationary pressures are a main concern for central banks globally. Persistent inflation above the BoC’s goal vary (presently 2%) compels the financial institution to lift rates of interest to chill down the economic system and curb value will increase. Conversely, if inflation falls under the goal, the BoC could take into account fee cuts, resulting in a lower within the 5-year bond fee. Key inflation indicators just like the Shopper Value Index (CPI) and core inflation are carefully watched by market members.

-

Financial Development: The tempo of financial development considerably impacts bond yields. Sturdy financial development usually results in larger inflation expectations and elevated demand for credit score, pushing bond yields upwards. Conversely, weak financial development could immediate the BoC to decrease rates of interest, resulting in decrease bond yields. GDP development figures, employment knowledge, and enterprise funding indicators are all related on this context.

-

World Financial Circumstances: Canada’s economic system is intertwined with the worldwide economic system. World occasions, comparable to geopolitical instability, main financial shifts within the US or different key buying and selling companions, and international provide chain disruptions, can all have an effect on the Canadian 5-year bond fee. For instance, a world recession might result in decrease demand for Canadian bonds and decrease yields, whereas sturdy international development might need the other impact.

-

Authorities Debt and Fiscal Coverage: The extent of presidency debt and the federal government’s fiscal coverage additionally play a job. Excessive authorities borrowing can improve the provision of bonds, doubtlessly placing downward strain on costs and upward strain on yields. Conversely, fiscal consolidation measures can scale back borrowing wants and doubtlessly decrease yields.

-

Market Sentiment and Hypothesis: Investor sentiment and hypothesis considerably affect bond costs and yields. Durations of heightened danger aversion can result in elevated demand for safe-haven belongings like authorities bonds, pushing costs up and yields down. Conversely, intervals of optimism and better danger tolerance can result in decrease demand for bonds and better yields.

Outlook for the Subsequent 5 Years:

Predicting the long run trajectory of the Canadian 5-year bond fee with certainty is unattainable. Nonetheless, based mostly on present financial circumstances and professional evaluation, a number of eventualities are believable:

-

Situation 1: Gradual Decline: If inflation continues to average and the BoC efficiently manages a gentle touchdown for the economic system, the 5-year bond fee might steadily decline over the subsequent 5 years. This state of affairs assumes sustained, albeit slower, financial development and a return of inflation to the BoC’s goal vary.

-

Situation 2: Vary-Sure Motion: The 5-year bond fee might stay comparatively range-bound, fluctuating inside a sure band. This state of affairs assumes a interval of average financial development, persistent however manageable inflationary pressures, and a cautious method from the BoC in adjusting rates of interest.

-

Situation 3: Additional Will increase (Much less Probably): A resurgence of inflation or sudden destructive financial shocks might result in additional will increase within the 5-year bond fee. This state of affairs is much less probably given the BoC’s dedication to bringing inflation again to its goal, however it stays a risk.

Funding Implications:

The 5-year bond fee’s trajectory considerably impacts numerous funding choices. For instance:

-

Fastened-Revenue Buyers: Decrease bond yields imply decrease returns for fixed-income buyers. Conversely, larger yields provide larger returns but additionally carry elevated rate of interest danger. Buyers have to fastidiously take into account their danger tolerance and funding horizon when making choices.

-

Mortgage Debtors: Adjustments within the 5-year bond fee instantly affect mortgage charges. Rising bond yields result in larger mortgage charges, growing the price of borrowing for homebuyers. Conversely, falling yields result in decrease mortgage charges.

-

Company Debtors: The 5-year bond fee impacts the price of borrowing for firms. Larger yields improve the price of financing, doubtlessly affecting funding choices and enterprise growth plans.

Conclusion:

The Canadian 5-year bond fee is a dynamic indicator reflecting the complicated interaction of varied financial and market forces. Whereas predicting its future trajectory with absolute precision is unattainable, understanding the important thing influencing components and monitoring related financial knowledge is essential for buyers, companies, and policymakers. Staying knowledgeable in regards to the BoC’s financial coverage choices, inflation developments, financial development prospects, and international financial circumstances is important for navigating the evolving panorama of Canadian bond markets. Steady monitoring and cautious evaluation are very important for making knowledgeable choices on this dynamic surroundings. The data supplied on this article is for informational functions solely and shouldn’t be construed as monetary recommendation. Seek the advice of with a professional monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has supplied worthwhile insights into Decoding the Canadian 5-12 months Bond Charge: A 5-12 months Outlook and Market Watch. We hope you discover this text informative and helpful. See you in our subsequent article!