Decoding the Canadian 5-Yr Bond: A Deep Dive into Market Watch and its Implications

Associated Articles: Decoding the Canadian 5-Yr Bond: A Deep Dive into Market Watch and its Implications

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to Decoding the Canadian 5-Yr Bond: A Deep Dive into Market Watch and its Implications. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Decoding the Canadian 5-Yr Bond: A Deep Dive into Market Watch and its Implications

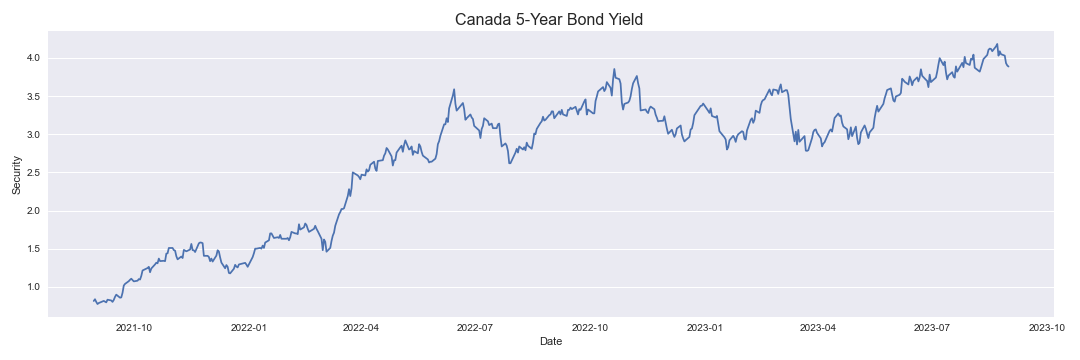

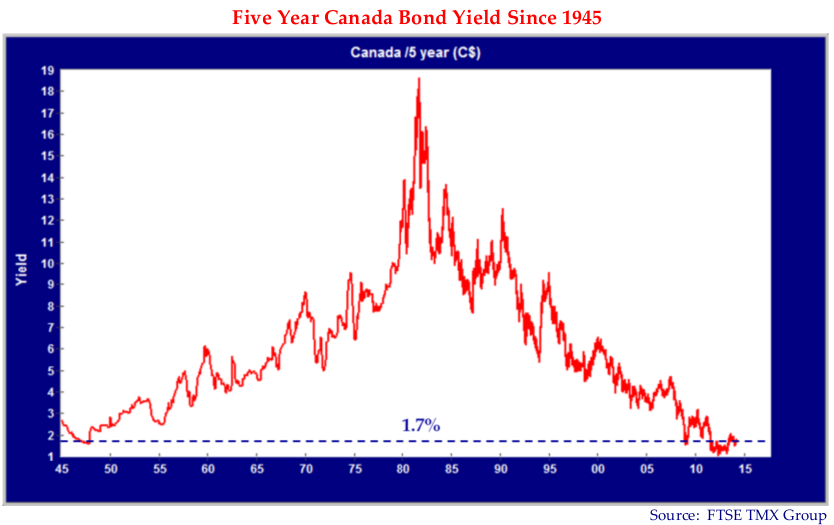

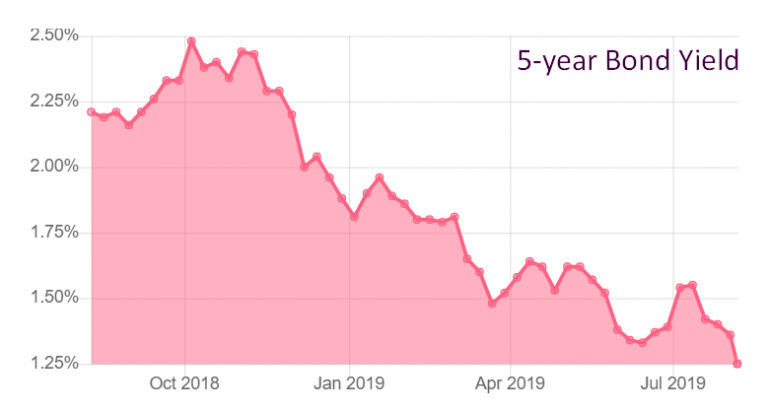

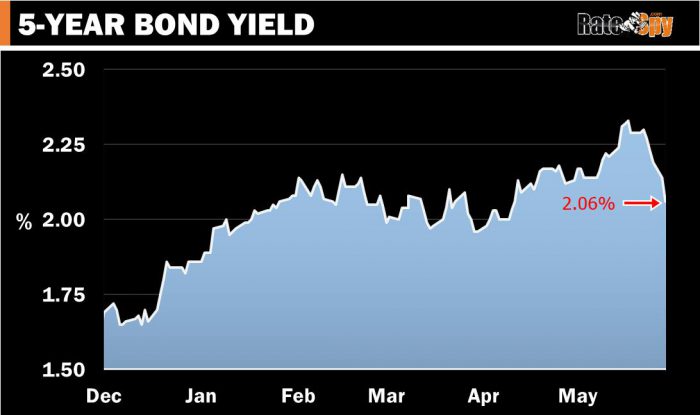

The Canadian 5-year bond, a cornerstone of the Canadian fixed-income market, offers a vital benchmark for rates of interest and displays broader financial sentiment. Understanding its efficiency, as tracked by sources like MarketWatch and different monetary information shops, is important for traders, companies, and policymakers alike. This text will delve into the complexities of the Canadian 5-year bond, exploring its position within the financial system, the elements influencing its yield, and its implications for varied stakeholders.

Understanding the Canadian 5-Yr Bond:

The Canadian 5-year bond, sometimes represented by the Authorities of Canada 5-year benchmark bond, is a debt instrument issued by the Canadian authorities. It guarantees to pay the bondholder a predetermined rate of interest (coupon) semi-annually for 5 years, after which the principal quantity is repaid. These bonds are thought of low-risk investments as a result of perceived creditworthiness of the Canadian authorities. Nonetheless, their worth fluctuates primarily based on market forces, impacting the yield traders obtain. MarketWatch, together with different monetary information suppliers, tracks the yield to maturity (YTM) of this benchmark bond, offering a key indicator of prevailing rates of interest in Canada.

The Significance of MarketWatch Information:

MarketWatch, a outstanding monetary information and information supplier, affords real-time and historic information on varied monetary devices, together with the Canadian 5-year bond. This information is essential for a number of causes:

- Benchmarking: The yield on the 5-year bond acts as a benchmark for different Canadian bonds with related maturities. It influences the pricing of company bonds, mortgages, and different debt devices.

- Curiosity Fee Expectations: Adjustments within the 5-year bond yield replicate market expectations relating to future rate of interest actions by the Financial institution of Canada. A rising yield suggests anticipation of upper rates of interest, whereas a falling yield signifies the alternative.

- Financial Sentiment: The bond yield is delicate to broader financial circumstances. Robust financial development typically results in greater yields as traders demand greater returns, whereas financial uncertainty or recessionary fears can push yields decrease as traders search safe-haven property.

- Funding Choices: Buyers use the 5-year bond yield to make knowledgeable selections about their portfolio allocation. They may shift in the direction of bonds if yields are engaging relative to different asset courses, or transfer in the direction of equities if yields are low.

- Coverage Implications: The Financial institution of Canada carefully displays the 5-year bond yield, because it offers insights into the effectiveness of its financial coverage. The central financial institution’s actions, similar to rate of interest changes, intention to affect the yield curve, together with the 5-year level.

Elements Influencing the 5-Yr Bond Yield:

A number of elements work together to find out the yield on the Canadian 5-year bond, as mirrored on MarketWatch and related platforms:

- Financial institution of Canada Coverage: The Financial institution of Canada’s financial coverage is essentially the most important affect. Rate of interest hikes typically result in greater bond yields, whereas charge cuts have the alternative impact. The central financial institution’s ahead steerage, indicating its future intentions, additionally performs a vital position.

- Inflation Expectations: Inflation is a key driver of bond yields. Larger inflation expectations result in greater yields as traders demand the next return to compensate for the erosion of buying energy. MarketWatch typically offers inflation forecasts that straight affect bond yield predictions.

- Financial Development: Robust financial development sometimes results in greater yields as traders anticipate elevated demand for credit score and better inflation. Conversely, weak financial development can depress yields. Information on GDP development, employment, and client spending, available by means of MarketWatch and different sources, are essential indicators.

- World Financial Situations: World financial occasions and geopolitical dangers can considerably affect Canadian bond yields. For example, world recessionary fears or main worldwide crises can push traders in the direction of the protection of Canadian authorities bonds, decreasing yields. MarketWatch offers complete protection of worldwide financial information, permitting traders to evaluate these exterior influences.

- Provide and Demand: The provision of Canadian authorities bonds and the demand from traders additionally play a job. Elevated authorities borrowing can improve provide, probably pushing yields greater, whereas sturdy investor demand can push yields decrease.

- Forex Fluctuations: Adjustments within the worth of the Canadian greenback can have an effect on the attractiveness of Canadian bonds to worldwide traders. A weakening Canadian greenback could make Canadian bonds extra engaging to overseas traders in search of greater yields in their very own currencies, probably driving down yields.

Deciphering MarketWatch Information and Making Knowledgeable Choices:

Analyzing the Canadian 5-year bond yield on MarketWatch requires a nuanced method. Merely wanting on the present yield is inadequate; it is essential to contemplate the historic context, the elements influencing the yield, and future expectations. Buyers ought to:

- Analyze the yield curve: Evaluate the 5-year yield to yields on bonds with completely different maturities. The form of the yield curve offers priceless insights into market expectations relating to future rates of interest.

- Take into account inflation-adjusted yields: Adjusting the nominal yield for inflation offers a clearer image of the true return traders can anticipate.

- Monitor financial indicators: Pay shut consideration to financial information launched by Statistics Canada and different sources, as these information factors considerably affect bond yields.

- Assess geopolitical dangers: Take into account the affect of worldwide occasions on the Canadian financial system and bond markets.

- Diversify investments: Do not rely solely on the Canadian 5-year bond. Diversification throughout completely different asset courses is essential for managing threat.

Conclusion:

The Canadian 5-year bond, as tracked by MarketWatch and different platforms, serves as an important barometer of the Canadian financial system and rate of interest expectations. Understanding the elements influencing its yield and decoding the information successfully is essential for making knowledgeable funding selections and navigating the complexities of the fixed-income market. By combining a radical evaluation of MarketWatch information with a broader understanding of macroeconomic tendencies and geopolitical elements, traders, companies, and policymakers can acquire priceless insights into the well being of the Canadian financial system and make strategic selections accordingly. Steady monitoring and a nuanced method are important for efficiently navigating the dynamic panorama of the Canadian bond market.

Closure

Thus, we hope this text has offered priceless insights into Decoding the Canadian 5-Yr Bond: A Deep Dive into Market Watch and its Implications. We admire your consideration to our article. See you in our subsequent article!