Decoding the Canadian 5-12 months Bond: A Deep Dive into Market Watch and Implications

Associated Articles: Decoding the Canadian 5-12 months Bond: A Deep Dive into Market Watch and Implications

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Canadian 5-12 months Bond: A Deep Dive into Market Watch and Implications. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Decoding the Canadian 5-12 months Bond: A Deep Dive into Market Watch and Implications

The Canadian 5-year bond, a cornerstone of the Canadian fixed-income market, gives a vital benchmark for rate of interest expectations and general financial well being. Understanding its actions, as mirrored in sources like Market Watch, is important for traders, companies, and policymakers alike. This text delves into the intricacies of the Canadian 5-year bond, exploring its function within the broader monetary panorama, the components influencing its yield, and the implications of its efficiency for the Canadian economic system.

Understanding the Canadian 5-12 months Bond

The Canadian 5-year bond, typically represented by its yield, is a debt instrument issued by the Authorities of Canada. It guarantees to pay the bondholder a predetermined rate of interest (coupon) semi-annually for 5 years, after which the principal is repaid. These bonds are thought-about low-risk investments because of the authorities’s backing, making them engaging to risk-averse traders in search of comparatively steady returns. Nevertheless, their yields fluctuate based mostly on numerous financial and market components, making them a dynamic asset class somewhat than a purely static funding.

Market Watch, a outstanding monetary information and knowledge supplier, affords real-time and historic knowledge on the Canadian 5-year bond yield. This knowledge is essential for understanding the present market sentiment and predicting future tendencies. By monitoring the yield, traders can achieve insights into:

-

Curiosity Charge Expectations: The 5-year bond yield displays market expectations relating to future rate of interest modifications by the Financial institution of Canada (BoC). A rising yield suggests expectations of upper rates of interest sooner or later, whereas a falling yield signifies expectations of decrease charges and even potential quantitative easing (QE) measures.

-

Financial Development Prospects: Sturdy financial progress typically results in larger rates of interest as demand for credit score will increase. This, in flip, pushes up bond yields. Conversely, weak financial progress can result in decrease yields as traders search safer havens.

-

Inflation Expectations: Inflation erodes the buying energy of future bond funds. Due to this fact, larger inflation expectations usually end in larger bond yields to compensate traders for the lack of buying energy.

-

International Market Circumstances: International financial occasions and geopolitical dangers can considerably influence the Canadian 5-year bond yield. For instance, international uncertainty may lead traders to hunt the protection of Canadian authorities bonds, driving down yields.

Elements Influencing the Canadian 5-12 months Bond Yield

A number of interconnected components affect the yield of the Canadian 5-year bond, as reported on platforms like Market Watch:

-

Financial institution of Canada Financial Coverage: The BoC’s actions relating to rate of interest targets are paramount. Charge hikes usually result in larger bond yields, whereas charge cuts result in decrease yields. The BoC’s ahead steerage, communicated by means of press releases and statements, additionally considerably impacts market expectations and bond yields.

-

Inflation: As beforehand talked about, larger inflation erodes the actual return of bonds. The BoC’s mandate contains controlling inflation, and its actions are closely influenced by inflation knowledge. Larger-than-expected inflation sometimes results in larger bond yields as traders demand compensation for inflation threat.

-

Financial Development: Sturdy financial progress often interprets to elevated demand for credit score, pushing up rates of interest and bond yields. Conversely, weak financial progress can result in decrease yields as traders search security in authorities bonds.

-

Authorities Debt Ranges: Excessive ranges of presidency debt can enhance issues concerning the authorities’s capability to repay its obligations, doubtlessly resulting in larger bond yields to compensate for elevated threat.

-

International Financial Circumstances: International financial occasions, equivalent to recessions in main economies or geopolitical instability, can influence investor sentiment and result in capital flows into or out of Canadian authorities bonds, influencing their yields.

-

Provide and Demand: The availability of Canadian 5-year bonds and the demand from traders play a essential function in figuring out the yield. Elevated provide can push yields larger, whereas elevated demand can push them decrease.

Decoding Market Watch Information on the Canadian 5-12 months Bond

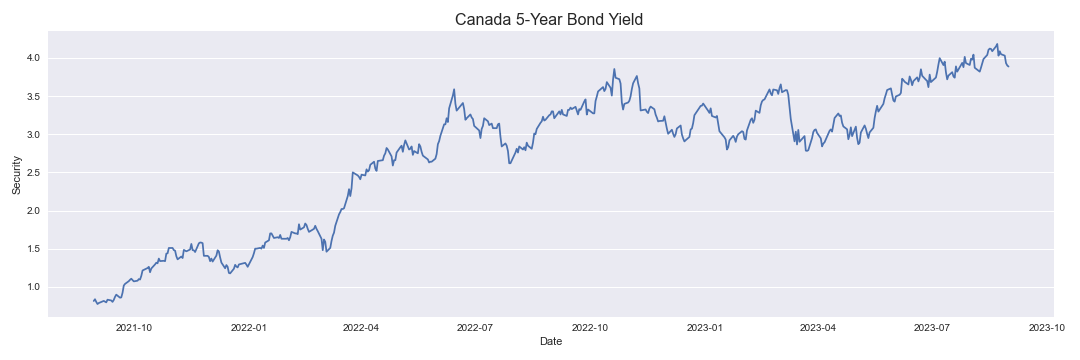

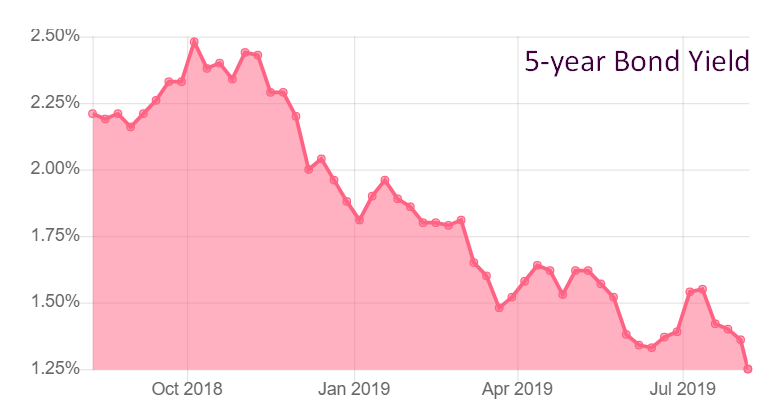

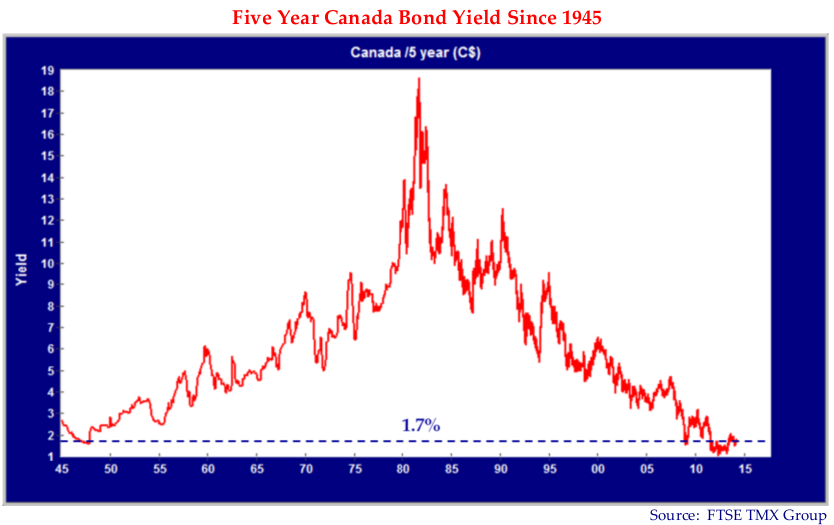

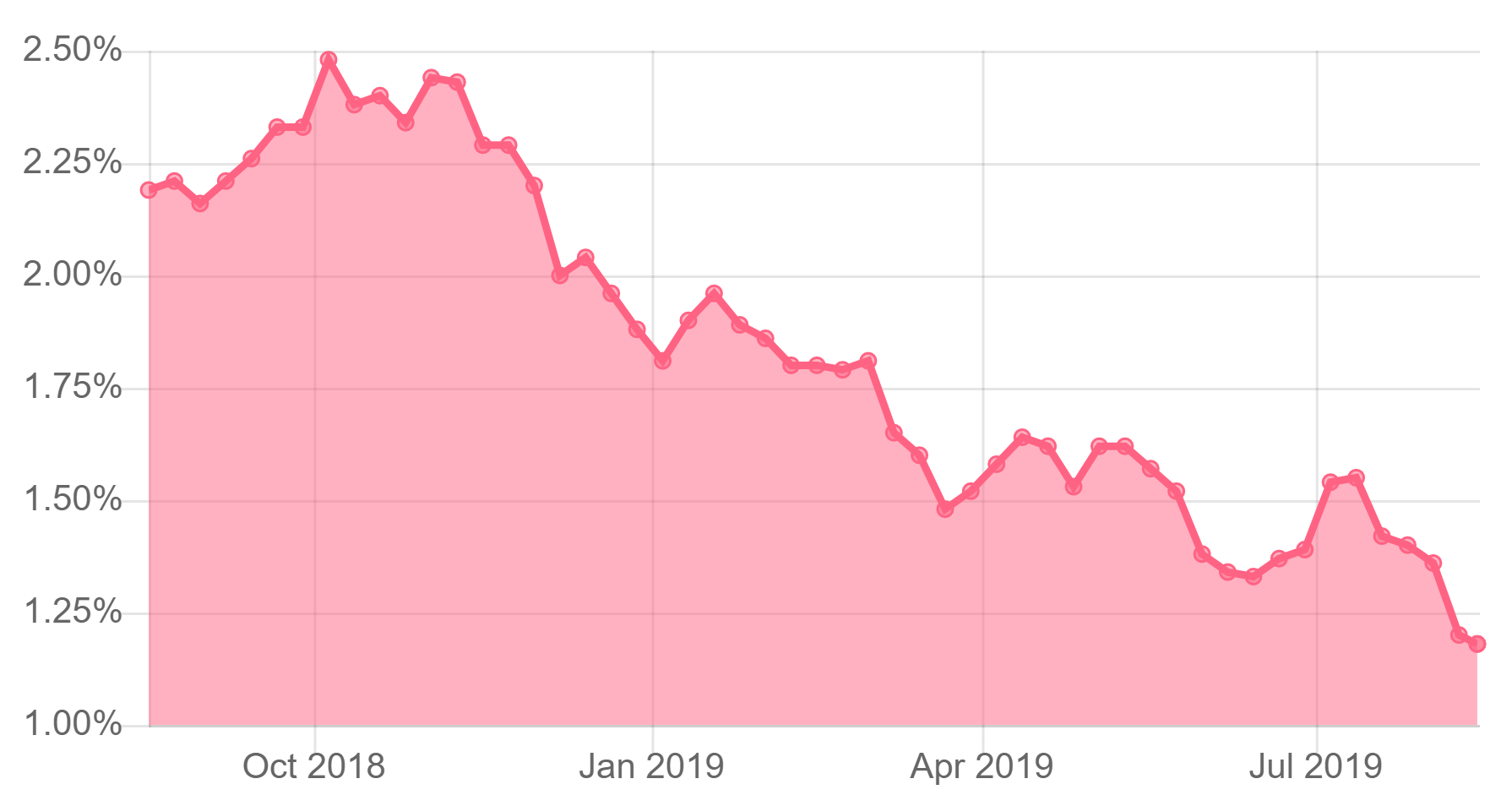

Market Watch gives a wealth of information, together with historic yield curves, permitting traders to research tendencies and patterns. By evaluating the present 5-year bond yield to historic knowledge, traders can assess whether or not the present yield is excessive or low relative to historic norms. Moreover, evaluating the 5-year yield to yields on different maturities (e.g., 2-year, 10-year bonds) gives insights into the form of the yield curve, which may sign expectations about future rate of interest modifications.

A steepening yield curve (longer-term yields rising sooner than shorter-term yields) typically suggests expectations of future rate of interest hikes, whereas a flattening or inverting yield curve (longer-term yields falling under shorter-term yields) can sign issues about future financial progress or perhaps a potential recession.

Implications for the Canadian Economic system

The Canadian 5-year bond yield has important implications for the Canadian economic system:

-

Borrowing Prices: The yield influences borrowing prices for companies and shoppers. Larger yields imply larger borrowing prices, doubtlessly slowing down financial exercise. Decrease yields encourage borrowing and funding, stimulating financial progress.

-

Funding Choices: Traders use bond yields to evaluate the relative attractiveness of investing in authorities bonds versus different asset lessons. Adjustments in bond yields can have an effect on funding flows into and out of the Canadian economic system.

-

Foreign money Trade Charges: Adjustments in bond yields can affect the Canadian greenback’s change charge. Larger yields can entice international funding, strengthening the Canadian greenback, whereas decrease yields can weaken it.

-

Financial Coverage Effectiveness: The BoC screens bond yields carefully to gauge the effectiveness of its financial coverage. Surprising actions in bond yields can sign that the market’s expectations differ from the BoC’s intentions, requiring changes to financial coverage.

Conclusion

The Canadian 5-year bond, as tracked by Market Watch and different monetary knowledge suppliers, serves as a vital indicator of financial well being and market sentiment. Understanding the components influencing its yield is essential for traders, companies, and policymakers alike. By rigorously analyzing the info obtainable on platforms like Market Watch, stakeholders can achieve worthwhile insights into rate of interest expectations, financial progress prospects, and the general path of the Canadian economic system. Nevertheless, it’s essential to keep in mind that bond yields are only one piece of the puzzle, and a complete understanding requires contemplating different financial indicators and market forces. Using the info successfully, mixed with a radical understanding of macroeconomic rules, is important for navigating the complexities of the Canadian bond market.

Closure

Thus, we hope this text has supplied worthwhile insights into Decoding the Canadian 5-12 months Bond: A Deep Dive into Market Watch and Implications. We recognize your consideration to our article. See you in our subsequent article!