Decoding the Canadian 1-Yr Bond Market: A Deep Dive into Market Watch Knowledge

Associated Articles: Decoding the Canadian 1-Yr Bond Market: A Deep Dive into Market Watch Knowledge

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Canadian 1-Yr Bond Market: A Deep Dive into Market Watch Knowledge. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Decoding the Canadian 1-Yr Bond Market: A Deep Dive into Market Watch Knowledge

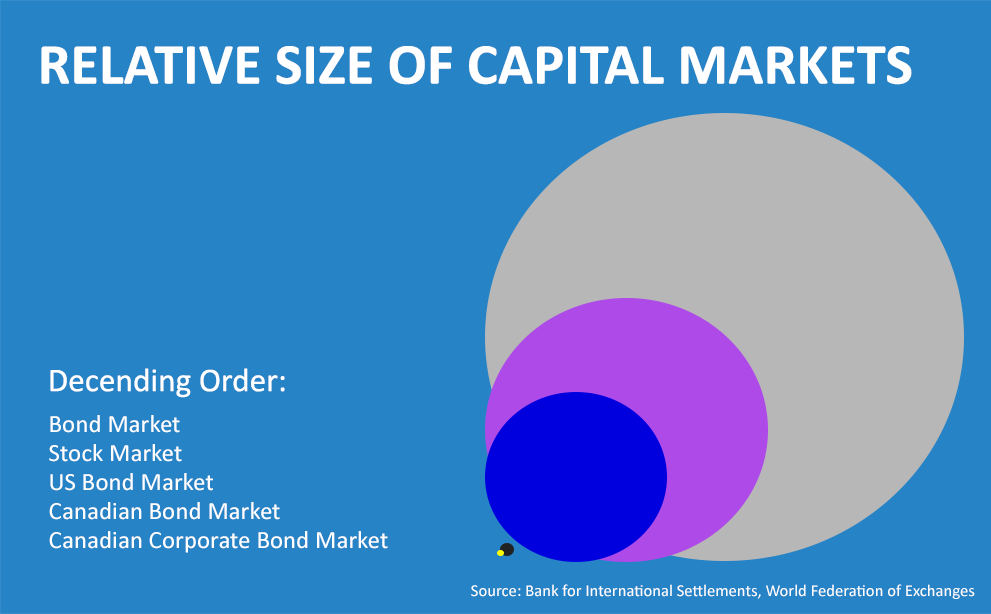

Canada’s bond market, a cornerstone of its monetary system, presents a various vary of funding alternatives. Amongst these, the 1-year Authorities of Canada bond holds a singular place, representing a benchmark for short-term rates of interest and risk-free returns. Analyzing knowledge from sources like Market Watch gives essential insights into its efficiency, influencing funding methods throughout varied sectors. This text will delve into the intricacies of the Canadian 1-year bond market, exploring its dynamics, influencing components, and implications for traders and the broader economic system.

Understanding the 1-Yr Authorities of Canada Bond:

The 1-year Authorities of Canada bond, also known as a T-bill (Treasury invoice) regardless of its barely longer maturity, is a debt instrument issued by the Canadian authorities. It represents a promise to repay the principal quantity plus accrued curiosity after one 12 months. These bonds are thought of nearly risk-free because of the authorities’s backing, making them a secure haven asset for traders in search of capital preservation. Nevertheless, their returns are usually decrease than these of higher-risk investments like company bonds or equities. Market Watch, together with different monetary knowledge suppliers, tracks the yield (the return on funding) of those bonds, offering real-time data essential for market members.

Key Components Influencing 1-Yr Bond Yields:

A number of interconnected components drive the yield on Canadian 1-year bonds, as reported by Market Watch and different sources. These embrace:

-

Financial institution of Canada Financial Coverage: The Financial institution of Canada’s (BoC) actions are paramount. Rate of interest hikes enhance borrowing prices, pushing bond yields upward. Conversely, charge cuts decrease yields, making bonds extra engaging. Market Watch intently displays BoC bulletins and their subsequent affect on bond yields. Anticipation of future charge adjustments, based mostly on financial forecasts and market sentiment, additionally considerably influences present yields.

-

Inflation Expectations: Inflation erodes the buying energy of cash. Traders demand larger yields on bonds to compensate for anticipated inflation. Market Watch tracks inflation knowledge (e.g., Shopper Value Index) and makes use of this data to gauge market expectations, which straight affect bond costs and yields. Larger-than-expected inflation typically results in larger bond yields.

-

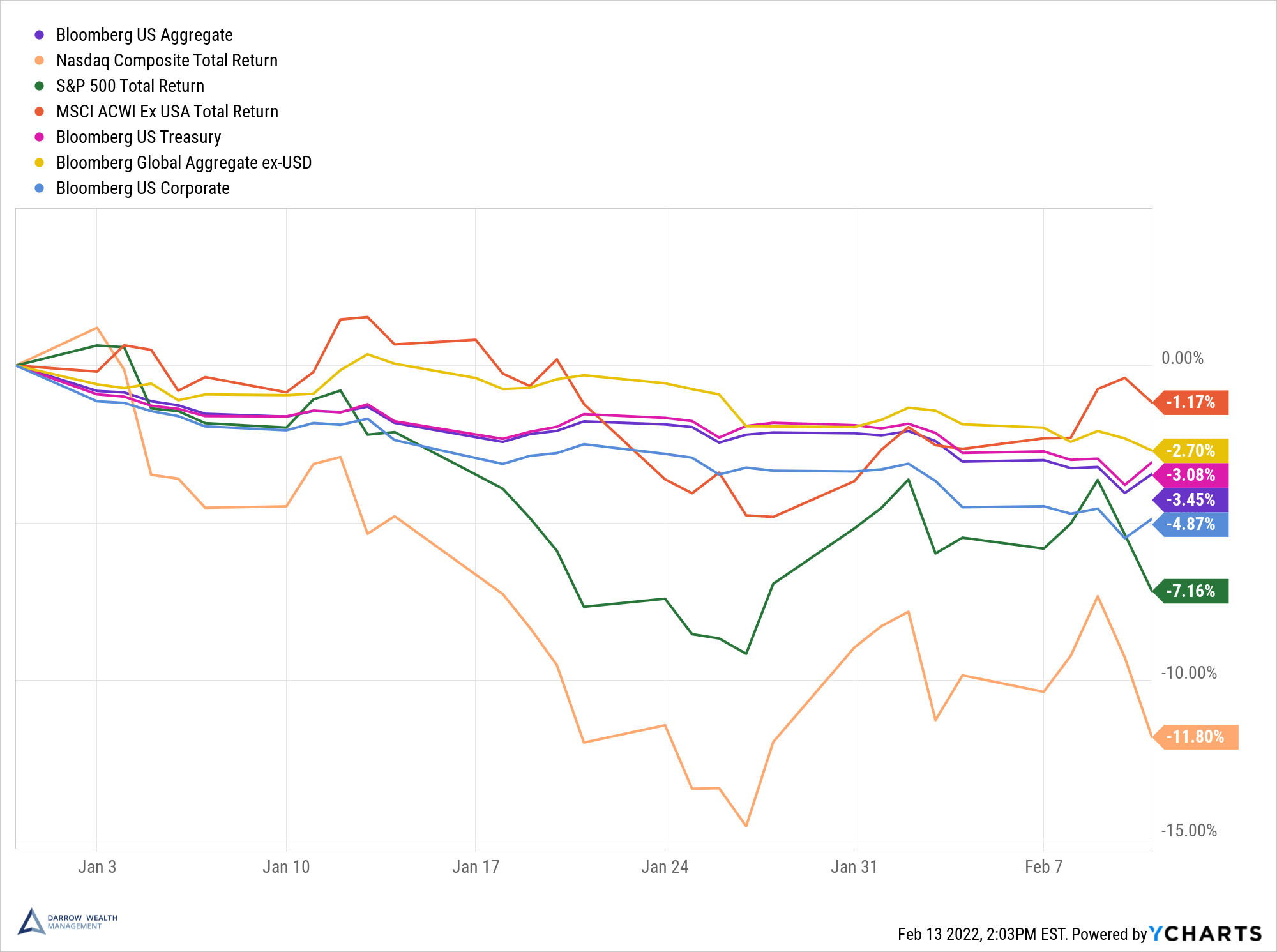

World Financial Circumstances: The worldwide financial panorama considerably impacts Canadian bond yields. World uncertainty, financial downturns, or geopolitical dangers usually push traders in direction of safer property like authorities bonds, growing demand and probably reducing yields (although this may be counteracted by different components). Market Watch gives a worldwide financial overview, permitting analysts to evaluate the worldwide context influencing Canadian bond markets.

-

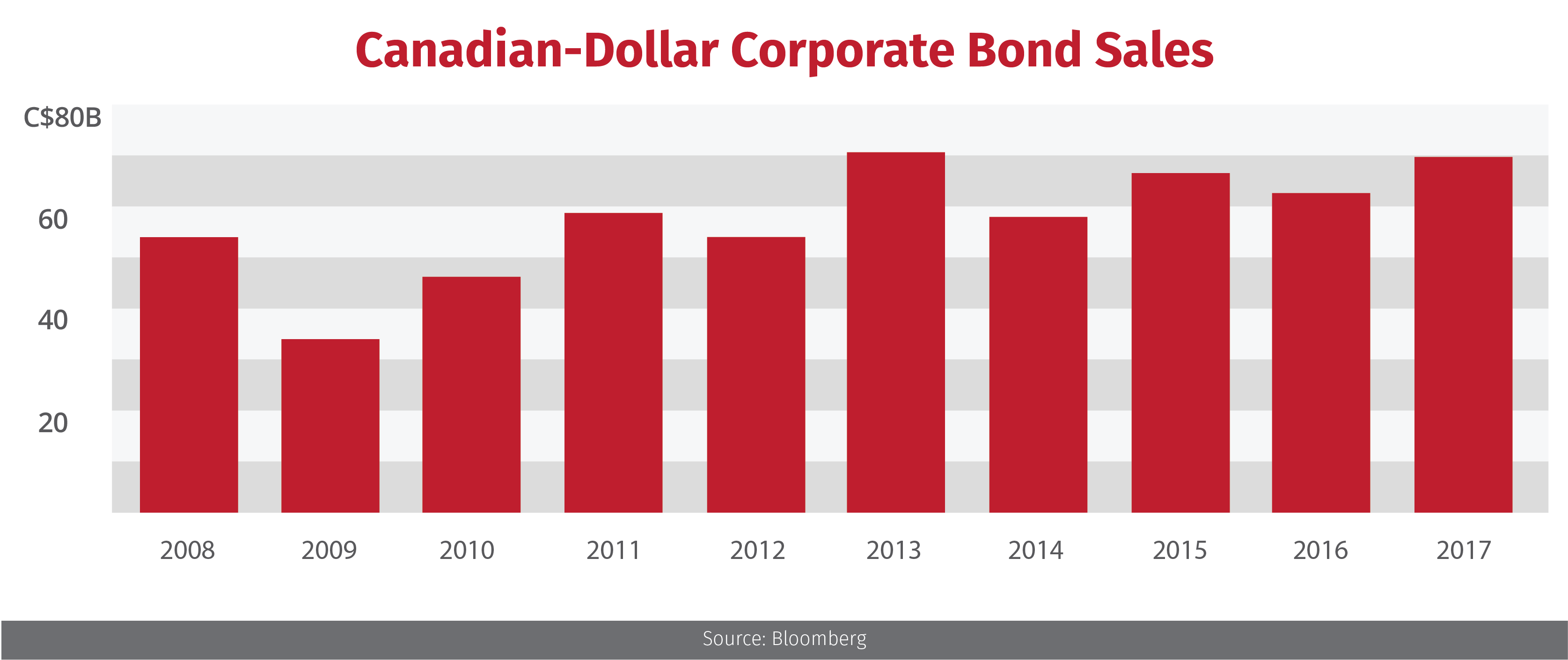

Provide and Demand: The availability of 1-year bonds issued by the federal government and the demand from traders play an important function. Elevated authorities borrowing (e.g., to finance deficits) can enhance provide, probably pushing yields larger. Conversely, robust investor demand, pushed by components like danger aversion or engaging yields relative to different investments, can decrease yields. Market Watch tracks authorities issuance schedules and gives insights into investor sentiment, serving to to gauge the supply-demand dynamics.

-

Forex Fluctuations: The Canadian greenback’s alternate charge towards different main currencies, notably the US greenback, not directly impacts bond yields. A weaker Canadian greenback could make Canadian bonds extra engaging to overseas traders in search of larger returns after forex conversion, probably driving down yields. Market Watch gives real-time alternate charge knowledge, permitting for a complete evaluation of this issue.

Deciphering Market Watch Knowledge on Canadian 1-Yr Bonds:

Market Watch gives varied knowledge factors associated to Canadian 1-year bonds, together with:

-

Yield to Maturity (YTM): This represents the full return an investor can anticipate in the event that they maintain the bond till maturity. Market Watch shows the YTM, which fluctuates based mostly on the components talked about above.

-

Bond Value: The value of a bond strikes inversely to its yield. A better yield implies a lower cost, and vice versa. Market Watch tracks the bond’s value, offering context to the yield adjustments.

-

Buying and selling Quantity: The amount of bonds traded signifies market exercise and liquidity. Excessive buying and selling quantity suggests a extra liquid market, making it simpler to purchase or promote bonds.

-

Unfold to Different Bonds: Evaluating the yield of the 1-year bond to different authorities bonds (e.g., longer-term bonds) reveals the yield curve’s form. The yield curve’s slope gives insights into market expectations relating to future rates of interest.

By analyzing these knowledge factors from Market Watch, traders and analysts can acquire a deeper understanding of the market’s sentiment and potential future tendencies.

Implications for Traders and the Financial system:

The Canadian 1-year bond market has important implications for varied stakeholders:

-

Traders: For conservative traders, 1-year bonds provide a comparatively secure haven with predictable returns. Nevertheless, the low yields won’t preserve tempo with inflation, impacting actual returns. Market Watch knowledge helps traders make knowledgeable choices about allocating capital to those bonds.

-

Companies: Companies use bond yields as a benchmark for borrowing prices. Larger yields enhance the price of borrowing, probably impacting funding choices and financial exercise.

-

Central Financial institution: The BoC intently displays bond yields to gauge the effectiveness of its financial coverage. Yield actions replicate market response to the BoC’s actions and inform future coverage choices.

-

Authorities: Authorities borrowing prices are straight linked to bond yields. Larger yields enhance the price of financing authorities debt, impacting fiscal coverage and budgetary planning.

Conclusion:

The Canadian 1-year bond market, as mirrored in Market Watch knowledge, is a dynamic and interconnected system influenced by a mess of things. Understanding these components and deciphering the info successfully is essential for traders, companies, and policymakers alike. Whereas the 1-year Authorities of Canada bond presents a comparatively secure funding, its low yields should be thought of towards inflation and different funding alternatives. Steady monitoring of Market Watch knowledge and a complete understanding of the underlying financial forces are important for navigating this very important phase of the Canadian monetary panorama. Moreover, incorporating macroeconomic forecasts and geopolitical evaluation alongside Market Watch’s real-time knowledge can present a extra holistic view, enabling better-informed choices in a continually evolving market. The interaction between financial coverage, inflation expectations, world financial situations, and provide and demand continues to form the yield of this significant benchmark bond, highlighting the significance of ongoing evaluation and knowledgeable decision-making.

Closure

Thus, we hope this text has supplied beneficial insights into Decoding the Canadian 1-Yr Bond Market: A Deep Dive into Market Watch Knowledge. We recognize your consideration to our article. See you in our subsequent article!